Global Air Freight Industry Seeks Standardized Operations

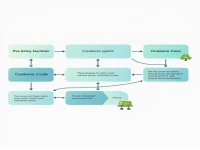

This article provides a detailed analysis of the entire international air freight process, from quotation to settlement, covering key steps such as booking, customs declaration, shipment, and tracking. It aims to offer companies a clear and practical standardized operating guideline for freight forwarders, helping them efficiently manage air freight operations, reduce transportation risks, and improve logistics efficiency. It serves as a comprehensive resource for businesses seeking to optimize their international air cargo strategies.